Popular Searches

Foreign trade zones (FTZ), sometimes known as free trade zones, are geographically designated and secured areas that for legal purposes are considered outside of US Customs territory. FTZs offer several economic advantages for companies involved in international trade. There are six general purpose FTZs serving North Carolina, five of which are based within the state, and eighteen active subzones approved for use by individual companies. In addition, three of the zones have successfully transitioned to the Alternative Site Framework (ASF), which greatly simplifies service to users. An ASF has a large, preapproved service area in which the organization in charge of the FTZ, the grantee, can propose new sites. Within this broad service area, which incorporates several counties, the grantee can work with interested companies to establish sites intended for either an individual company’s use or the use of several companies.

Foreign or domestic merchandise may enter an FTZ without a formal customs entry document or payment of customs duties or government excise taxes. If the final product is exported from the United States, no customs duty is levied. If the final product is imported into the U.S., duty and excise taxes are due at the time of transfer from the FTZ and formal entry is made into the United States. Duty is paid on the product itself or its imported parts, whichever is lower.

Generally, merchandise is exempt from payment of duty even if it is:

- Manipulated;

- Used in a manufacturing process;

- Inspected;

- Combined with other domestic or foreign materials;

- Displayed for sale, or

- Re-exported.

- Spoiled or damaged goods or waste materials may be destroyed, discarded or re-exported duty-free.

State and local governments generally do not impose sales and use taxes on items in an FTZ. For this reason, a company operating in such a zone can realize savings on such taxes as well as on interest, labor and shipping costs.

New capital investment by companies that might otherwise have located in foreign countries is another important advantage. This new investment activity spurs development of support industries.

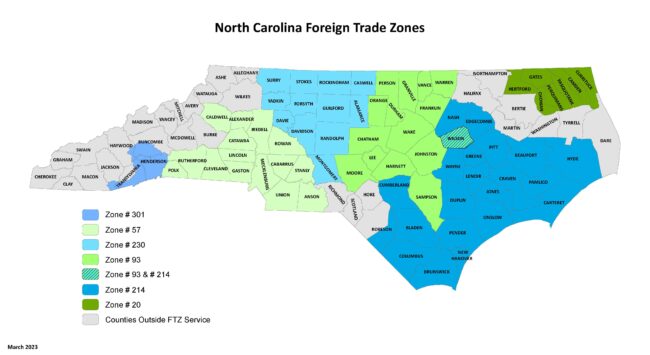

Map of North Carolina Foreign Trade Zones

The six foreign trade zones serving North Carolina are:

- Zone #214 – This zone includes the Port of Wilmington, Port of Morehead City and the NC Global TransPark. Zone #214 is administered by the North Carolina Department of Transportation (NCDOT). The administrator for this zone is Emily Jones Wiley.

- Zone #93 – The Greater Research Triangle Zone is based in Durham. Zone #93 is administered by the Triangle J Council of Governments. The administrator for this zone is Alex Halloway.

- Zone #230 – The Piedmont Triad Zone is based in Greensboro. Zone #230 is administered by the Piedmont Triad Partnership. The administrator for this zone is Penny Whiteheart.

- Zone #57 – The Greater Charlotte Zone is based in Charlotte. Zone # 57 is administered by the Charlotte Regional Business Alliance. The administrator for this zone is Laura Foor.

- Zone #20 – The Northeast NC Zone is based in Norfolk, Virginia. Zone #20 is administered by the Virginia Port Authority. The administrator for this zone is Laura Swankler.

- Zone #301 – The Land of Sky Zone is based in Asheville. Zone #301 is administered by Land of Sky Regional Council. The administrator for this zone is Renée Wyatt Boyette.

Get in Touch